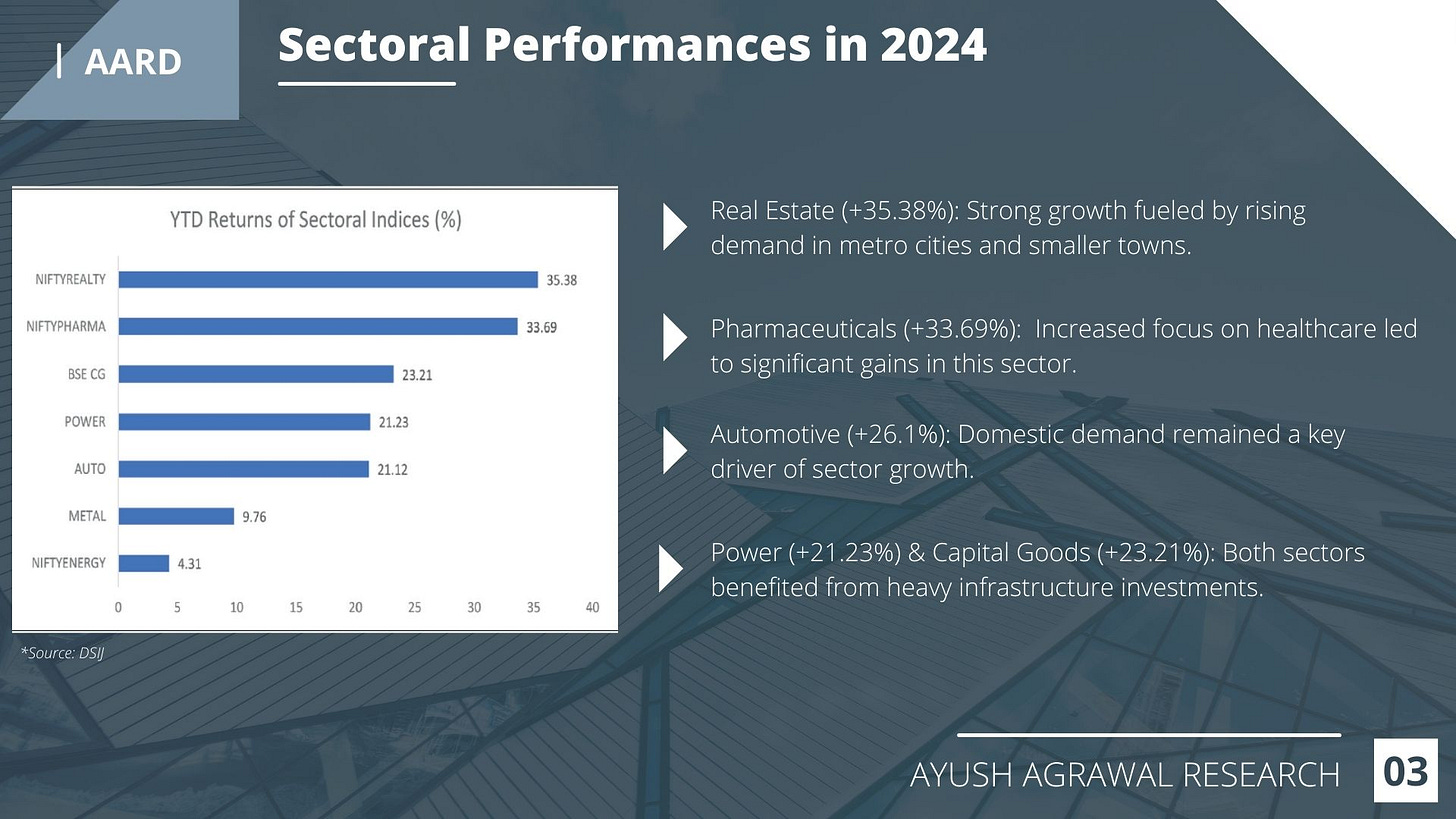

As 2024 draws to a close, the Indian stock market reflects a year marked by volatility and resilience. Despite challenges, the indices showed remarkable strength, with the Nifty delivering a solid 10% gain. However, the broader market stole the limelight, as the BSE Midcap and Smallcap indices surged by 25% and 30%, respectively. This divergence highlights the potential for outsized returns in the midcap and smallcap segments during favorable market conditions.

We will be hosting a webinar deep diving into the Market Outlook for 2025

📅Date: 4th Jan 2025, Saturday

⌚ Time: 12 PM

Liquidity: The Lifeblood of 2024

The primary driver of 2024’s bullish market was the influx of liquidity, largely from retail investors and HNIs. This robust participation sustained valuations despite slowing corporate earnings growth.

Valuation Metrics

-

Nifty PE Ratio: Remained above 20 throughout the year, closing at around 22. While not yet in overvalued territory, a PE above 25 would signal potential risks.

-

Smallcap-to-Sensex Ratio: Climbed to 0.7, significantly exceeding the long-term median of 0.45. For context, a similar peak in January 2018 preceded a 40% correction in the smallcap index.

-

Broader Market Valuation: Despite higher valuations, earnings of all smallcap companies combined equaled just 36% of Sensex companies’ total earnings. This disparity highlights the elevated risks in the smallcap space.

Central Bank Policies and Global Markets

-

Global markets in 2024 were significantly influenced by central bank decisions. The U.S. Federal Reserve pivoted mid-year, announcing its first interest rate cut since 2020 in September to counter slowing economic growth. While this move provided relief to equity markets, challenges such as geopolitical tensions, crude oil price volatility, and economic instability in Europe and China tempered optimism.

-

In contrast, India’s Reserve Bank maintained a steady hand, balancing inflation control with growth support. This stable monetary stance underlined the importance of central bank strategies in shaping market sentiment. Investors who anticipated these shifts were better equipped to manage volatility.

Outlook for 2025

While the long-term outlook for Indian equities remains bullish, several factors will shape the market trajectory in 2025:

-

Union Budget 2025: Expected capital expenditure push could benefit sectors like infrastructure, defense, and railways.

-

Interest Rates: A potential RBI rate cut in early 2025 could ease borrowing costs, providing relief to consumption and housing sectors.

-

Global Developments: Donald Trump’s presidency and China+1 strategies could open export opportunities for Indian manufacturing.

2024 was a year of challenges that rewarded strategic thinking and adaptability. As markets evolve, the lessons learned this year will guide investors to capitalize on opportunities in 2025 and beyond. Elevated valuations, slowing earnings growth, and geopolitical uncertainties signal the need for caution in 2025. While caution remains necessary, optimism and informed decisions can pave the way for future success.

🎄 Holiday Season Offer 🎁

Celebrate the festive season with Ayush Agrawal Research!

Get 10% OFF on our Core and smallcase services.

Click Link for Core Plan: https://ayushagrawal.in/core

Click Link for smallcase Plan: https://aard.smallcase.com/smallcase/AAGRMO_0001

👉 Use Code: NEW YEAR

I am a SEBI Registered Research Analyst,

To Subscribe to Bharat Next Emerging Giants, go to: https://ayushagrawal.in/basket/

Other Services:

Retail Research: www.ayushagrawal.in/core

HNI Research: www.ayushagrawal.in/titanium

Free Newsletter: www.themicrocapminute.in

Read the detailed Terms & Condition Here: https://ayushagrawal.in/terms-conditions/

Advertisement Number – BSE/RA/ADVT/12112024-5849/01

Disclaimer

All information is sourced from publicly available data, and while every effort has been made to ensure the accuracy and reliability of the information provided in these notes from the management meeting, Ayush Agarwal Research cannot guarantee that the information is complete or free from errors.

-

I, Ayush Agrawal, am registered with SEBI as an Individual Research Analyst under the registration number INH000013013, effective from September 14, 2023.

-

I offer paid research services to my clients based on this certification. Opinions expressed otherwise regarding specific securities are not investment advice and shall not be treated as recommendations. Neither I nor my associates/ employees shall not be liable for any losses incurred based on such opinions.

-

All matter displayed in this content is purely for Illustrative, Knowledge and Informational purpose and shall not be treated as advice or opinion of any kind.

-

The content presented should not be construed as investment advice unless explicitly stated in a client-specific research report. I or my employees/associates shall not be held liable/responsible in any manner whatsoever for any losses the readers may incur due to acting upon this content.

-

All information is taken from publicly available sources and data. I make no warranties or guarantees regarding the accuracy, completeness, or timeliness of the information provided, including data such as news, prices, and analysis. In no event shall I be liable to any person for any decision made or action taken in reliance upon the information provided by me.

-

We cannot guarantee the completeness or reliability of the information presented. Readers are encouraged to conduct their own research and consult with a professional advisor before making any investment decisions.