⭐ Subscribe to our Bharat Next Emerging Giants smallcase ⭐

Susbcribe for Rs. 1750 for 3 Months

Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

Investment in securities market are subject to market risks.

Read all the related documents carefully

Introduction

The Indian cement industry is currently navigating a transformative period marked by aggressive consolidation, capacity expansions, and strategic acquisitions as companies seek to strengthen market positions and respond to growing demand pressures. Major players like Ambuja Cements and UltraTech Cement are actively pursuing acquisitions and expansions, redefining the competitive landscape. This article explores these industry shifts, evaluates growth drivers, and delves into Ambuja Cements as a case study exemplifying these trends.

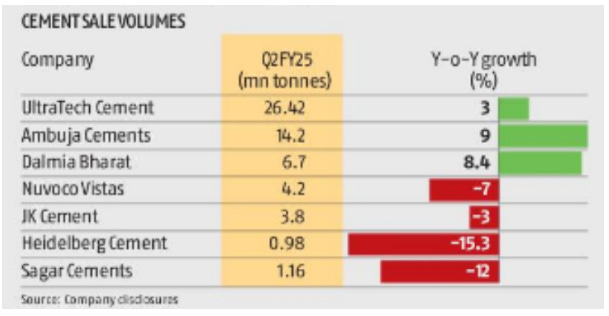

Industry Landscape: Consolidation and Expansion

The Indian cement industry has been experiencing an increasing trend of consolidation as large players attempt to increase market share and operational efficiencies. Ambuja Cements, now under the Adani Group, has spearheaded this drive through strategic acquisitions. For instance, Ambuja’s acquisition of a 46.8% stake in Orient Cement in October 2024 for approximately ₹81 billion highlights its intent to secure additional capacity and geographic reach. Similarly, UltraTech Cement has pursued its own acquisitions, including a 23% stake in India Cements for ₹18.85 billion, intensifying competition between India’s largest cement producers.

These acquisitions underscore a broader consolidation wave that many analysts believe has yet to reach its peak, driven by the need for operational cost reductions and economies of scale. The consolidation wave is helping companies streamline production and supply chain efficiencies, offering opportunities to increase profitability even in a challenging demand environment. By integrating smaller players, large companies are also securing key resources like limestone, a crucial raw material in cement production.

Demand Drivers: Infrastructure, Urbanization, and Real Estate

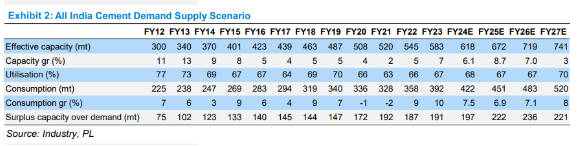

India’s cement demand is expected to grow at a compound annual growth rate (CAGR) of 7.5% through FY23-26, reaching approximately 485 million tonnes. This demand is primarily driven by several factors:

-

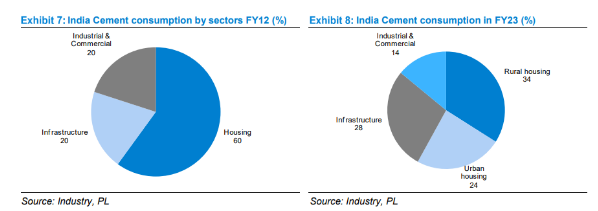

Government Infrastructure Projects: With the government’s continued focus on infrastructure development, including road construction, metro rail projects, and public transportation upgrades, there is a robust demand pipeline for cement. Approximately 42% of the National Infrastructure Pipeline (NIP) projects are currently underway, contributing significantly to the cement industry’s growth.

-

Urbanization: Rapid urbanization has led to increased demand for infrastructure, urban housing, and commercial buildings, creating steady demand for cement. Notably, metro rail expansions, with over 632 kilometers under development, are expected to require around 24 million tons of cement. The government’s urban housing schemes, such as PMAY-U, further support this demand.

-

Rural and Affordable Housing: The PMAY-G scheme launched in 2016 aims to provide “Housing for All,” with over 25.6 million homes built by mid-2024. The scheme’s continued rollout underscores the government’s commitment to bridging housing gaps, particularly in rural areas, and has created a consistent demand source for cement.

With these demand factors in mind, cement companies have announced plans to add approximately 130 million tonnes of capacity over the next three years, positioning themselves to capture the anticipated demand growth.

Challenges: Price Pressures and Rising Costs

While demand prospects appear strong, the cement industry faces several key challenges:

-

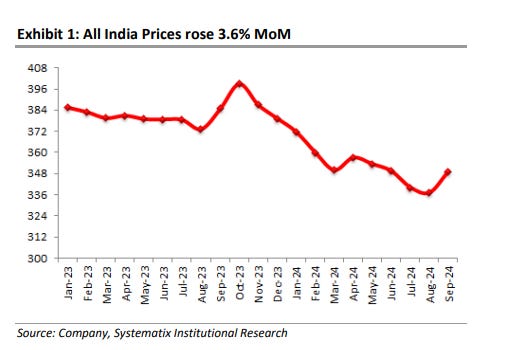

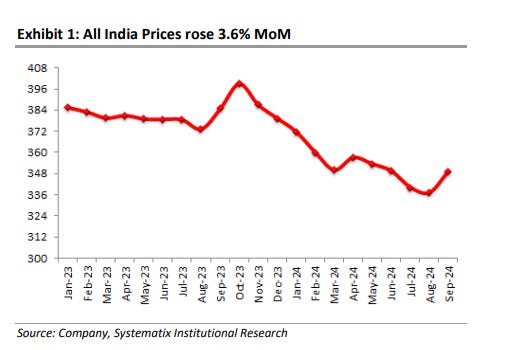

Pricing Instability: The industry has faced pricing pressures recently, with price hikes of ₹35-40 per bag implemented in mid-August and early September 2024. However, the second round of increases faced rollbacks in many regions due to weak demand, highlighting the challenges companies face in stabilizing prices.

-

Rising Input Costs: Smaller cement companies, in particular, are feeling the strain of rising raw material and fuel costs. Increased prices for coal, petcoke, and other raw materials have tightened margins, particularly for firms unable to scale operations or offset costs. As a result, some smaller players are struggling to maintain profitability, which may lead to further consolidation within the sector.

⭐ Subscribe to our Bharat Next Emerging Giants smallcase ⭐

Susbcribe for Rs. 1750 for 3 Months

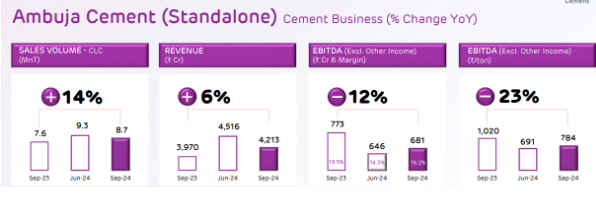

Ambuja Cements: A Case Study

Ambuja Cements, under the Adani Group, is a prime example of a company leveraging consolidation and capacity expansion to strengthen its market presence and operational efficiency. Through a series of strategic acquisitions, Ambuja has significantly increased its production capacity and secured valuable raw material resources.

Strategic Acquisitions and Capacity Expansion

Ambuja has been actively pursuing acquisitions to expand its reach and capacity. Notable acquisitions include a 46.8% stake in Orient Cement, which has increased Ambuja’s production capacity to approximately 97.4 million tonnes per annum (MTPA), edging closer to its target of 140 MTPA by FY28. Additionally, Ambuja’s acquisition of Penna Cement Industries for $1.25 billion has bolstered its position in southern India, where demand growth is particularly strong due to infrastructure projects and urban housing.

These acquisitions are expected to drive Ambuja’s market share from its current ~15% to approximately 20% by FY28. The company’s capacity expansion strategy is also supported by a strong balance sheet, with nearly ₹60,000 crore in net worth and no debt obligations, providing it with ample resources for both organic and inorganic growth.

Sustainable Growth and Operational Efficiency

Ambuja Cements is equally focused on sustainable practices, aiming to make a significant impact through green initiatives. By FY28, Ambuja has set a target for 60% green power usage and 27% green fuel consumption, aligning with Adani Group’s broader sustainability goals. The company also aims to reduce its operational costs by ₹530 per tonne over the next three years, with ₹150 per tonne already achieved through efficiency improvements. This commitment to sustainability not only aligns with global environmental trends but also positions Ambuja as a forward-thinking leader in the cement industry.

Resource Security and Competitive Positioning

Limestone reserves are crucial in cement production, and Ambuja’s strategic acquisitions have helped it secure a robust supply base. The company currently holds 8 billion tonnes of limestone reserves, second only to UltraTech’s 10 billion tonnes. In contrast, UltraTech has adopted a more conservative approach in expanding its limestone resources, choosing instead to focus on capacity utilization. This differentiation in strategy highlights Ambuja’s emphasis on securing long-term supply chains to support its growth trajectory.

With aggressive expansion, sustainable initiatives, and significant limestone reserves, Ambuja Cements is well-positioned to compete with UltraTech and other top players in the sector.

Sector Outlook

Despite the industry’s strong growth fundamentals, there are potential risks on the horizon:

-

Supply Chain and Input Cost Pressures: Raw material price fluctuations, especially in coal and petcoke, could increase operational costs and pressure margins, particularly for smaller firms.

-

Overcapacity and Pricing Challenges: The rapid expansion in capacity could lead to overcapacity in certain regions, creating pricing pressures that could erode profitability if demand fails to keep pace.

It is estimated that there would be a 4-5% growth in cement demand for FY25, with demand picking up in the second half due to infrastructure projects and housing activities. However, achieving sustainable growth will require companies to balance capacity expansions with market demand and remain adaptable to external economic shocks.

The Indian cement industry is at a crossroads, driven by consolidation, capacity expansion, and ambitious sustainability goals. Ambuja Cements exemplifies these shifts, with its aggressive acquisition strategy and commitment to sustainable practices setting a benchmark for the sector. As the industry navigates challenges such as pricing pressures, input cost volatility, and potential economic disruptions, companies that effectively balance growth with adaptability are likely to emerge as leaders in this evolving market landscape.

In the face of rapid changes, Ambuja Cements’ strategy of resource security, capacity growth, and sustainability initiatives positions it as a formidable player in the Indian cement industry, capable of contending with industry giants like UltraTech Cement. The future of India’s cement sector appears promising, provided companies can effectively navigate both opportunities and challenges.

⭐ Subscribe to our Bharat Next Emerging Giants smallcase ⭐

Susbcribe for Rs. 1750 for 3 Months

Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

Investment in securities market are subject to market risks.

Read all the related documents carefully

Disclaimer

-

I, Ayush Agrawal, am registered with SEBI as an Individual Research Analyst under the registration number INH000013013, effective September 14, 2023.

-

I offer paid research services to my clients based on this certification. Opinions expressed otherwise regarding specific securities are not investment advice and shall not be treated as recommendations. Neither I nor my associates/ employees shall be liable for any losses incurred based on such opinions.

-

Any matter displayed in the content posted here is purely for Illustrative, Knowledge and Informational purposes and shall not be treated as advice or opinion of any kind.

-

The content presented should not be construed as investment advice.

-

I or my employees/associates shall not be held liable/responsible in any manner whatsoever for any losses the readers may incur due to acting upon this content.

-

I make no warranties or guarantees regarding the accuracy, completeness, or timeliness of the information provided.

-

In no event shall I be liable to any person for any decision made or action taken in reliance upon the information provided by me.

-

I do not hold any positions in the securities mentioned, nor have I traded in these securities in the past 30 trading days. I also do not plan to trade in the next 5 trading days.

-

Paid clients receive detailed research reports and detailed analyses on all my research. For stock/company-specific investment recommendations, visit

https://ayushagrawal.in/services to learn about my paid research services.

-

The information here do not constitute a recommendation to buy/ sell and are for illustrative and for general informational purposes only.

Ayush Agrawal

Research Analyst

SEBI Registration No. INH000013013

BSE Enlistment No. : 5849

First Floor, B.P. Complex, Baldeobagh,

Jabalpur, Madhya Pradesh, 482002

Email: themicrocapinvestor@gmail.com

Number: +91 9425412028

GST Number: 23AHUPA5526E2ZJ